In the rapidly evolving world of cryptocurrencies, mining machine hosting has emerged as a pivotal sector, attracting investors and tech enthusiasts alike. As the popularity of cryptocurrencies such as Bitcoin, Ethereum, and Dogecoin surges, so does the demand for efficient and reliable mining rigs. Hosting these machines offers a unique pathway to participate in the cryptocurrency ecosystem while mitigating some of the inherent risks associated with direct ownership and management.

The allure of Bitcoin, with its limited supply and decentralized nature, speaks to a growing desire for independence from traditional financial systems. Yet, the task of mining Bitcoin isn’t trivial; it requires substantial upfront investment in hardware, as well as continuous operational costs related to electricity and cooling. Here is where hosting comes into play, offering miners the ability to utilize a shared infrastructure at a fraction of the cost, easing the burden on individual miners who may be hesitating or unable to afford high-end equipment.

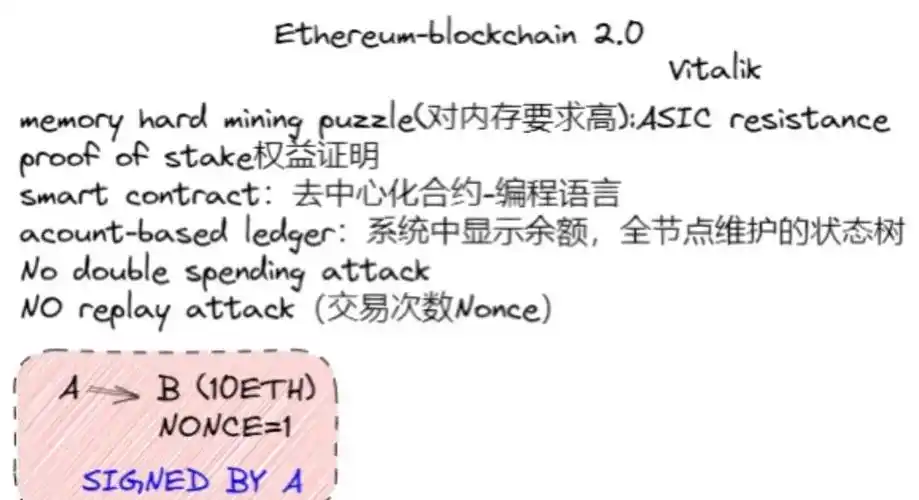

Ethereum and Dogecoin add layers of complexity to the hosting dialogue. Ethereum, transitioning from proof-of-work to proof-of-stake, can still lure miners with its high transaction volumes and rewards. The migration, however, poses risks to those relying solely on mining as a revenue stream. In contrast, Dogecoin, with its community-driven support, presents opportunities for miners seeking to diversify their portfolios—encouraging the establishment of small, localized hosting facilities that can operate on minimal scales.

Choosing a hosting provider is not merely a decision based on cost; various factors need careful consideration. The reputation of the host, the quality of their equipment, the reliability of their power supply, and their cooling solutions all play crucial roles in ensuring that the mining machines operate at optimal efficiency. For instance, downtime can result in significant losses, particularly in a market as volatile as cryptocurrency. A capable hosting provider will not only offer state-of-the-art mining rigs but will also prioritize the stability and security of their facility.

As one delves deeper into the mining machine hosting venture, it becomes imperative to understand the legal frameworks governing cryptocurrency in your jurisdiction. Regulatory landscapes can significantly impact operations, possibly resulting in additional costs or even prohibitions on certain activities. For miners, adaptability is key; a shift in regulations can create new opportunities or pose unforeseen challenges.

The economic feasibility of mining machine hosting also deserves attention. The profitability of mining, especially for Bitcoin, fluctuates with market conditions, mining difficulty, and electricity costs. When engaging in hosting services, it is crucial to perform a thorough cost-benefit analysis, factoring in all associated expenses, including maintenance fees and service charges. Only then can potential miners ascertain if hosting presents a more lucrative option compared to solo mining.

In a wild and unpredictable market, the concept of diversification is particularly relevant. Just as seasoned investors advise spreading investments across various assets to mitigate risks, so too should miners consider diversifying their operations. By exploring options beyond Bitcoin, such as Lesser-known altcoins, investors can shield themselves against market downturns, capitalizing on burgeoning cryptocurrencies that show promise.

Ultimately, the potential rewards of mining machine hosting can be enticing, waving a banner of financial independence and the thrill of being part of a disruptive technological movement. However, wise investors will proceed with caution, balancing the risks against the possible gains. As the cryptocurrency landscape evolves, staying informed and agile within this dynamic field is indispensable. Will you seize the opportunity or tread lightly?

Leave a Reply