The quest for maximizing Bitcoin rewards in the ever-evolving landscape of cryptocurrency mining is a constant pursuit. As we approach 2025, the choice of a mining pool becomes more critical than ever. Forget solitary mining; joining a pool allows miners to combine their computational power, increasing the likelihood of solving blocks and receiving regular payouts, albeit smaller ones, than if they struck gold solo. But which pools will reign supreme in the coming year? Factors like hash rate, fee structure, payout methods, server location, and reputation all play pivotal roles.

Diving deep into the Bitcoin mining ecosystem reveals a complex web of interconnected components. Each transaction, each block, each reward is meticulously recorded on the immutable blockchain ledger. This ledger, secured by cryptography, is the backbone of Bitcoin and all its potential. Understanding the intricacies of this system is paramount for any miner aiming to optimize their operations.

Beyond Bitcoin, the allure of other cryptocurrencies, particularly Ethereum and Dogecoin, remains strong. Ethereum, with its transition to Proof-of-Stake, has significantly altered its mining landscape, yet opportunities persist in staking and related activities. Dogecoin, fueled by its passionate community and meme-driven popularity, continues to attract miners seeking quick and accessible entry into the crypto world. The choice between mining Bitcoin, Ethereum (pre-merge), or Dogecoin often boils down to individual risk tolerance, available hardware, and belief in the long-term potential of each currency.

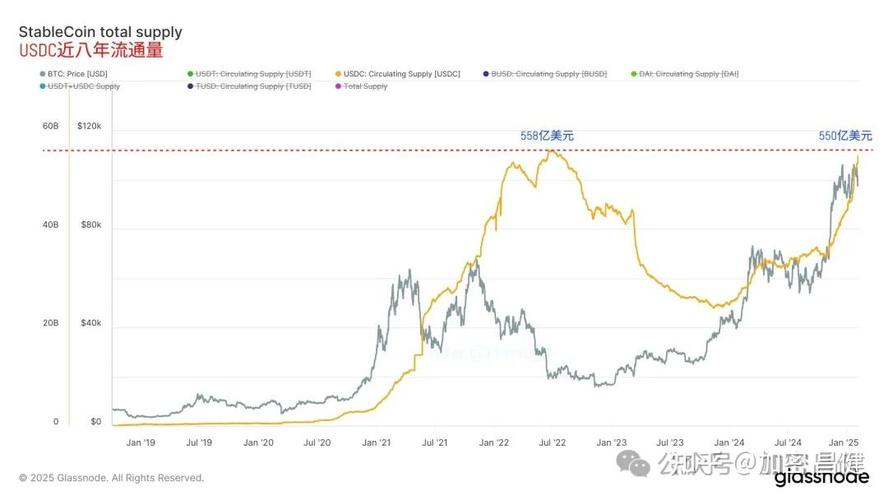

The profitability of mining is inextricably linked to the price of Bitcoin and other mined cryptocurrencies. A surge in Bitcoin’s value can drastically increase mining revenue, attracting more miners and, consequently, raising the difficulty of finding new blocks. Conversely, a price drop can squeeze margins, forcing less efficient miners to shut down. This constant interplay between price, difficulty, and mining rewards creates a dynamic and often unpredictable market.

Enter the ASIC miner, the workhorse of the Bitcoin mining world. These specialized machines are designed solely for the purpose of hashing Bitcoin transactions, offering significantly higher performance than general-purpose computers or even GPUs. Investing in the right ASIC miner is crucial for maintaining profitability, but the rapid pace of technological advancement means that these machines can become obsolete relatively quickly. This creates a constant need for miners to upgrade their hardware to stay competitive.

Mining farms, vast warehouses filled with rows upon rows of ASIC miners, represent the industrial scale of Bitcoin mining. These operations require significant upfront investment, access to cheap electricity, and sophisticated cooling systems to prevent overheating. The economies of scale enjoyed by mining farms allow them to operate with higher efficiency and profitability than smaller, independent miners. However, they also face challenges related to regulation, environmental concerns, and security.

Mining rig hosting services offer a solution for individuals who want to participate in Bitcoin mining without the hassle of managing their own hardware. These services provide space, electricity, and maintenance for your mining rigs, allowing you to earn rewards without having to worry about the technical details. However, it’s essential to carefully vet hosting providers, as security breaches and unreliable service can significantly impact your profitability.

The rise of decentralized exchanges (DEXs) and centralized exchanges (CEXs) has also impacted the mining landscape. These platforms provide miners with a convenient way to convert their Bitcoin rewards into fiat currency or other cryptocurrencies. The liquidity and trading volume of these exchanges can significantly influence the price of Bitcoin, indirectly affecting mining profitability.

Looking ahead to 2025, several key trends are likely to shape the Bitcoin mining landscape. Increased regulatory scrutiny, particularly regarding environmental impact, will likely force miners to adopt more sustainable practices. The development of more energy-efficient ASIC miners will also be crucial for reducing the carbon footprint of Bitcoin mining. Furthermore, the increasing complexity of mining operations will likely lead to greater consolidation, with larger mining farms dominating the market.

Choosing the best Bitcoin mining pool in 2025 will require careful consideration of these factors. Miners should prioritize pools with low fees, reliable payout methods, and a strong reputation. They should also consider the pool’s hash rate and server location to ensure optimal performance. By staying informed and adapting to the ever-changing landscape, miners can maximize their rewards and contribute to the continued growth and security of the Bitcoin network.

Ultimately, the future of Bitcoin mining depends on innovation, sustainability, and collaboration. As the industry matures, miners will need to embrace new technologies and practices to remain competitive and ensure the long-term viability of Bitcoin.

Leave a Reply